By now you know that due to the rise of a rare “divergence” phenomenon, we’re standing on the cusp of the moneymaking opportunity of the century.

To recap, the divergence is an ultra-rare stock market trend that my team and I discovered, when stock prices significantly diverge from their underlying fundamentals. This only occurs about once a decade. And if you know how to identify and capitalize on it, you can make truly life-changing money.

We’re talking turning thousands into millions.

This rare phenomenon is on the rise right now. But the perfect time to buy hasn’t arrived quite yet. Our models indicate this moment of “peak divergence” is just days away. When our proprietary indicators start flashing BUY, we’ll let you know immediately.

In the meantime, we’re doing a little “crash course” on this phenomenon. Specifically, we’re illustrating its power by looking back on historical divergences.

Yesterday, we told you all about the First Great Divergence of the late 1980s. Capitalizing on that would’ve led you to buying Microsoft (MSFT) stock at 40 cents and Apple (AAPL) stock at 20 cents – decisions that have since turned modest $10,000 investments into multimillion-dollar paydays.

But believe it or not, that divergence was a small one.

That is, the Second Great Divergence of 2001 was far bigger – and it produced far greater returns.

Remember the Dot-Com Crash?

The Second Great Divergence emerged in the early 2000s, with most occurring in 2001.

At that time, the market was reeling from the bursting of the dot-com bubble. Sentiment was dreary, as investors were still licking their wounds from the broken dreams and hollow promises of many internet startups. And to make matters worse, the U.S. economy was tumbling into a recession.

There was a lot of fear in the market – just like there was in the late 1980s. And yet again, all that fear pushed investors to sell indiscriminately. And this produced enormous divergences in companies with very strong fundamentals.

Like the computer companies of the 1980s, the internet companies of the early 2000s were the market’s fastest growers. And they were also the market’s biggest losers during the 2001 market downturn.

The result? The Second Great Divergence – out of which emerged the best opportunity to buy internet stocks ever!

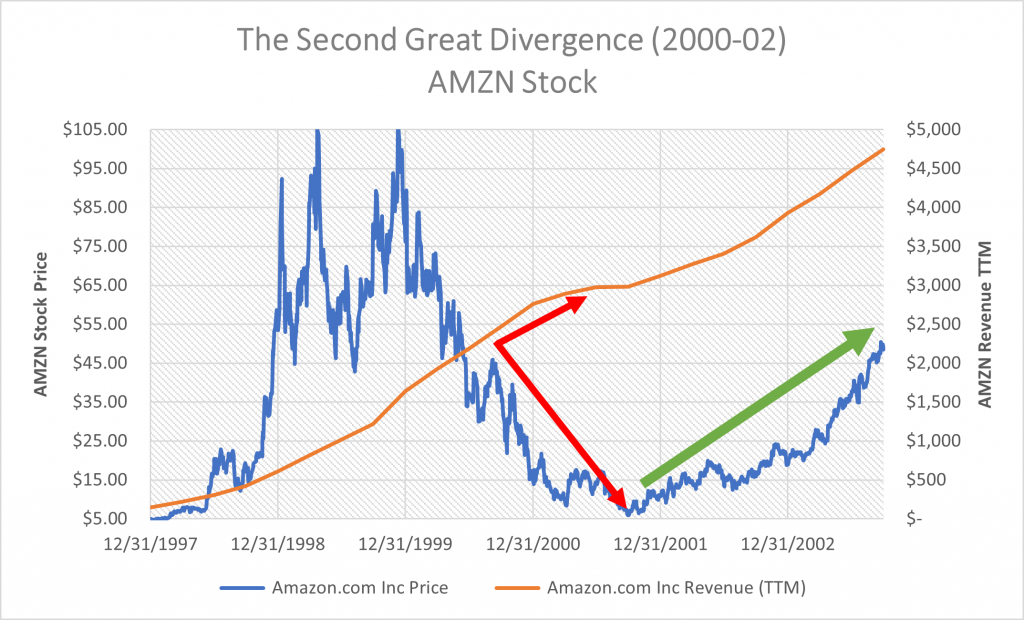

Example 1: Amazon (AMZN).

From December 1999 to September 2001, Amazon stock dropped a mind-boggling 92%. And during that stretch, revenues shot up 82%. This was a deviation like no other – not even that of the First Great Divergence.

The result? A rally like no one had ever seen.

Within a year, Amazon stock popped 166%. Within two years, it had risen 707%. And two decades later, it’s up 52,860%.

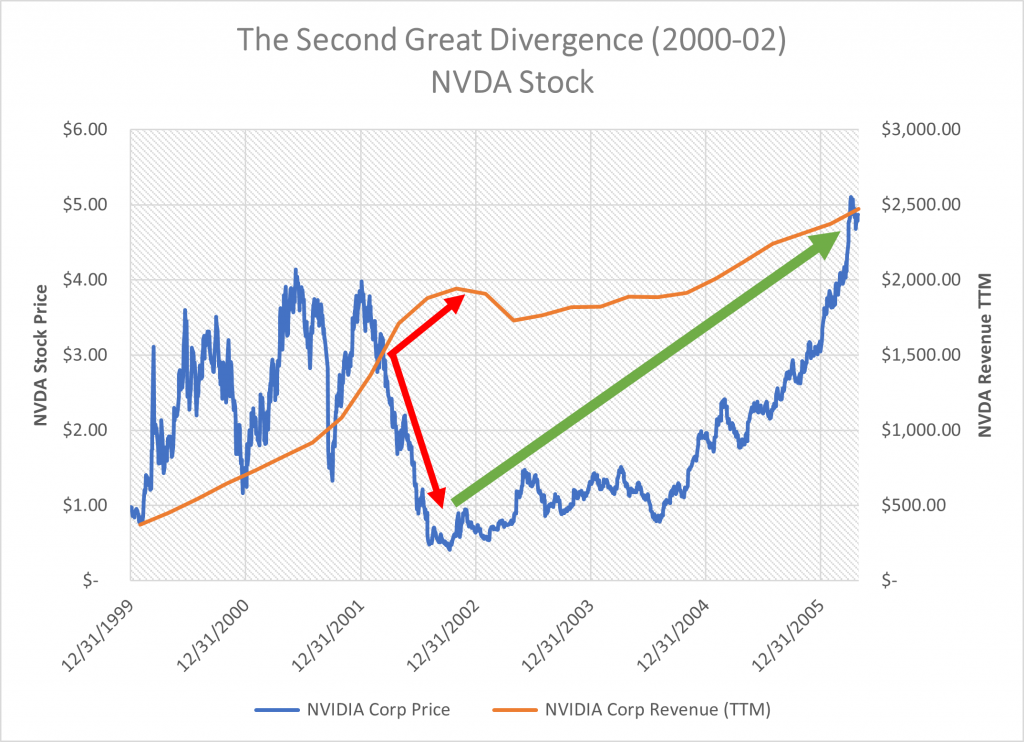

Another potent example from the Second Great Divergence is Nvidia (NVDA).

The GPU maker’s stock shed an eye-watering 87% between June 2001 and September 2002. During that plunge, Nvidia’s revenues rose 134%. Like Amazon’s it was a record divergence that investors had never grappled with before.

Within a year, NVDA was up 85%. And since then, Nvidia stock has rallied a grand total of 55,650%.

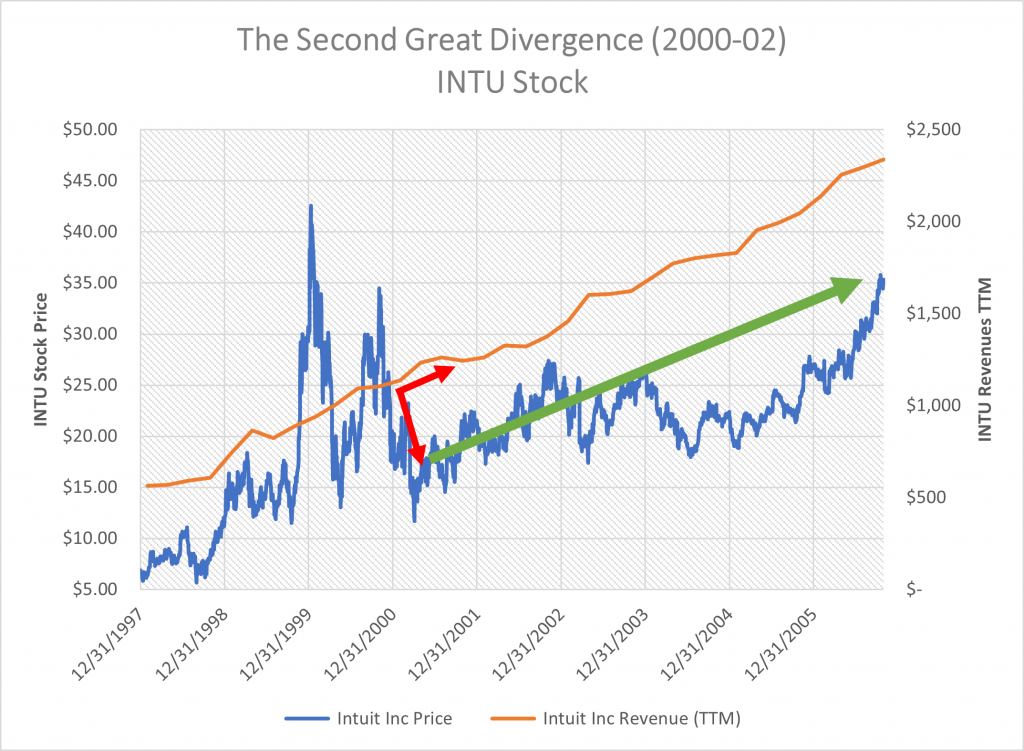

A less extreme example from the Second Great Divergence is Intuit (INTU).

Between November 2000 and April 2001, the stock fell 47%, while revenues rose 12%. Since then, it has risen 3,150%.

In other words, the First Great Divergence of the late 1980s was big – but the Second Great Divergence of the early 2000s was even bigger.

In fact, it was enormous.And the investors who capitalized on it are sitting on 50,000%-plus gains today.

Amazing, right? But do you want to know what’s even more amazing? The Third Great Divergence was even bigger yet.

I know. That’s tough to believe, but it’s true. And tomorrow, I’m going to prove it to you with data.

Until then, just know this:

- We’ve discovered an ultra-rare stock market phenomenon that’s emerging right now.

- Historically, investors who capitalized on it at just the right moment had the chance to turn $10,000 investments into multimillion-dollar paydays.

- We’ve developed proprietary signals to tell us when stocks hit “peak divergence.”

- Our models are telling us that this height is rapidly approaching.

- When it hits, we’ll tell you right away – and you’ll be locked in to capitalize on the moneymaking opportunity of the century.

So, be sure to stay tuned over the next few days. Peak divergence could arrive at any moment. And you don’t want to miss it.