Folks, after 14 years, the next big Divergence is finally here.

Of course, you should by now know all about the ultra-rare divergence phenomenon. Occurring roughly once a decade (during peak market volatility), divergences create generational opportunity. Meaning you can buy tomorrow’s best-performing stocks at today’s biggest discounts.

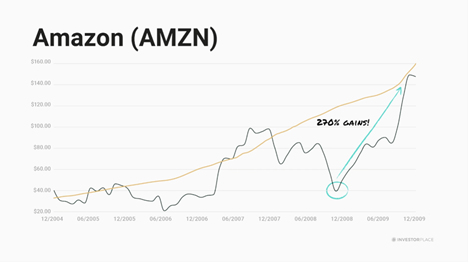

Previous divergences signaled investors to buy Microsoft (MSFT) stock at 40 cents… Apple (AAPL) stock at 20 cents… Amazon (AMZN) stock at $5… and Netflix (NFLX) stock at $2. We’re talking a life-changing investment opportunity to turn thousands into millions.

And now, for the first time in 14 years, one of these divergences is happening across the U.S. stock market. It is, like clockwork, creating yet another wave of generational investment opportunities.

We’ve spent the past seven months researching these opportunities. At last, 30 minutes before the markets closed yesterday, our models went haywire. The perfect time to capitalize on this divergence has arrived.

Examples of the Next Big Divergence

If revenues are moving higher, the stock should be moving higher, too. If revenues are dropping, the stock should be dropping. Divergences occur when stock prices diverge from their fundamentals — when revenues and earnings keep moving higher, but the stock price drops. This creates a generational buying opportunity in the divergent stock.

And right now, we are seeing some huge divergences emerge in certain stocks across the market. Indeed, these are some of the biggest divergences we’ve seen in the history of the stock market.

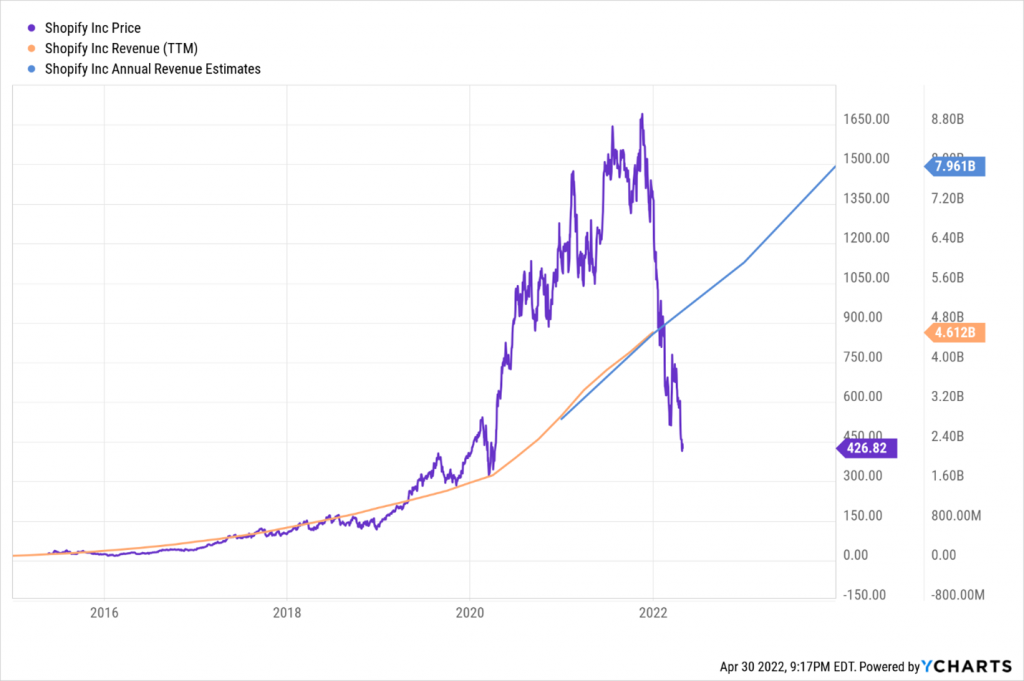

Take Shopify (SHOP), for example.

Shopify is riding the wave of online selling trends and the democratization of retail. Its revenues have been – and still are — and projected to keep growing very quickly. Yet, SHOP stock has collapsed recently, creating what is an enormous divergence between fundamentals and the stock price. By the numbers, this is one of the largest divergences we’ve ever seen.

What historically happens is the purple line “snaps back” very rapidly to the blue line, setting the stage for quick triple-digit gains in the stock. Our numbers indicate that, due to this divergence, Shopify stock could double in a hurry:

Or consider Roku (ROKU).

“The cable box of streaming” has always grown like wildfire as more users, content, and ad dollars shift into the streaming TV space.

Yet, the stock price has collapsed — without a drop in Roku’s revenues — creating an enormous divergence. Our numbers indicate that this is one of the largest divergences in history and will result in a fast, 200%-plus rally in Roku stock:

Across the stock market today, we are seeing some huge divergences — just like Roku and Shopify — emerge in individual stocks with great growth potential. This is creating an ultra-compelling investment opportunity, the likes of which we haven’t seen since 2008.

The Bigger the Divergence, the Bigger the Returns

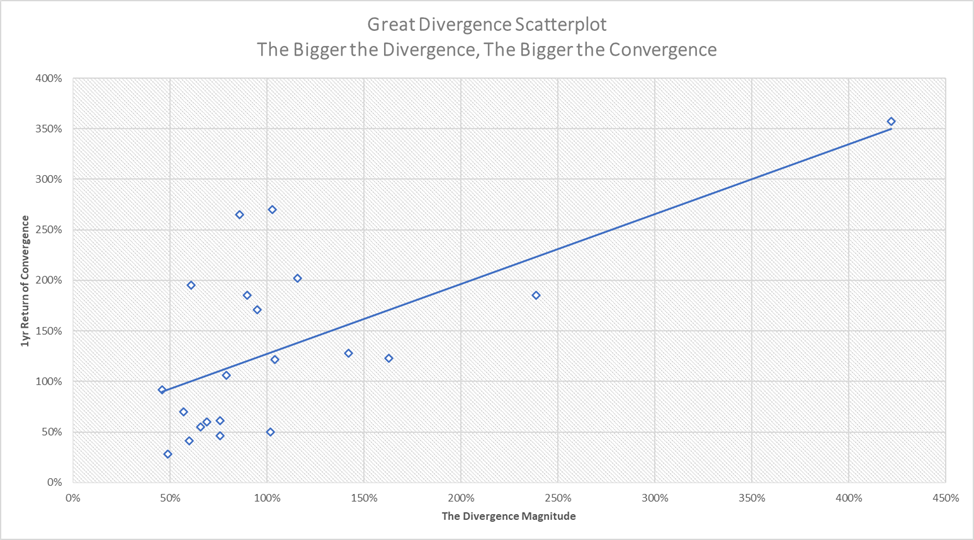

One of the more interesting discoveries we made about these divergence phenomena is that, in short, size matters.

That is, we’ve found that the bigger the divergence, the bigger the convergence.

Take a look at the following scatter plot. It graphs the size of various divergences (the x-axis) alongside the size of the 12-month forward returns in those divergences (the y-axis) across multiple historical examples from 1988, 2001, and 2008.

Clearly, there is a positive relationship between divergence and returns. The bigger the divergence, the bigger the forward returns.

That’s important, because as noted earlier, what we’re observing today across the market are some of the biggest divergence examples we’ve ever seen.

Of course, there’s Shopify and Roku. But, relative to some of the other divergences out there, those are small.

Right now, we’re seeing some stocks reporting divergence magnitudes of 500 percentage points or more.

Those are the stocks that stand to win the most in Divergence 2022 — and they are the stocks I’m researching intimately right now.

3X Average Returns in 12 Months?

We’re still finishing up our full report on The 1,000% Divergence Window Portfolio, But I’m too excited to wait until 4 p.m.! In the meantime, I can share some hints about that report…

These 10 stocks are showing unprecedentedly large divergences today. Which, historically speaking, means they’ll post unprecedentedly large returns over the next 12 months.

In our historical analysis, we found a direct correlation between the size of the divergence and the size of the opportunity. That is, the bigger the divergence, the bigger the forward returns. We can quantitatively model this relationship and — based on the size of the divergence — loosely predict forward 12-month returns.

Our top 10 Divergence 2022 stocks have a record “spread” of 200 percentage points – meaning that, on average, their stock prices are about 200 percentage points diverged from their fundamentals. Based on our divergence quant model, that puts the average 12-month return across all 10 stocks at 200%-plus.

In other words, our historically proven divergence quant model tells us that these 10 stocks could triple over the next year.

Talk about turning today’s market volatility into tomorrow’s personal opportunity.

These aren’t just “divergent stocks” — they are rapidly growing, fundamentally superior stocks seeing a surge of insider buying. And Wall Street’s brightest analysts think these stocks can more than double in a hurry.

Fundamentally Superior Stocks

Beyond being super divergent, the 10 stocks in the special research report we plan to release this afternoon are simply fundamentally superior in every way.

Each company is a leader in a hypergrowth market — sporting huge competitive advantages — and pioneering a novel solution in a huge addressable market. What’s more, each has exceptional technology, is led by a stellar management team, and has tremendous long-term opportunity.

These are long-term mega-winners.

Best of all, each stock on our list is incredibly cheap relative to their growth potential. The average estimated revenue growth rate in 2022 across these 10 stocks? About 67%. The average forward price-to-sales multiple? 2.2X.

That’s amazing. The whole market is trading at a similar forward sales multiple yet growing sales at a ~10% clip. Basically, you can buy these 10 divergence stocks today at the same multiple as the S&P 500 while getting nearly 7X the revenue growth firepower.

That’s the power of the divergence — It allows us to buy super-charged growth stocks at value prices.

Beyond being cheap, these stocks are also ones that insiders are loading up on right now. Of the 10 stocks, six of them have experienced significant insider buying over the past few months.

And, perhaps above all else, both Wall Street and Morningstar analysts see tremendous upside potential in these stocks. The average Wall Street price target across these 10 divergence stocks implies 135% upside potential. The average Morningstar price target implies 113% upside potential.

In other words, these aren’t just divergence stocks. They are fundamentally superior stocks growing at lightspeed, trading at a dirt-cheap valuation, with huge insider buying and enormous 12-month upside potential.

They’re the most exciting stocks in the market.

The Final Word

I’ve never been more excited — or exhausted — in my entire investment career.

We sit on the precipice of the biggest money-making opportunity of the century. Investors who make the right moves today have the potential to forever alter their financial future.

To help you do that, please tune in today for an emergency “divergence briefing” this afternoon, at 4 p.m. ET. In it, I’ll reveal how you can access our report on the 10 best divergence stocks to buy to capitalize on this rare opportunity.

I earnestly believe that by just attending that briefing, getting access to that report, and buying those 10 stocks, you could put yourself in a position to turn a modest $10,000 investment into a potential million-dollar payday.

That’s not hyperbole — that’s honesty.

Its honesty based on months of research, dozens of case studies, hundreds of charts, and thousands of data points.

Previous divergence windows gave investors the chance to turn thousands into millions. This one could be even bigger.

Now, I could go on and on, but I’m going make a coffee and finish up this report.

I’ll see you this afternoon at 4 p.m. sharp.