Dig Deeper

An Inside Look:

How I discovered the biggest wealth-building opportunity of the century

Luke Lango here.

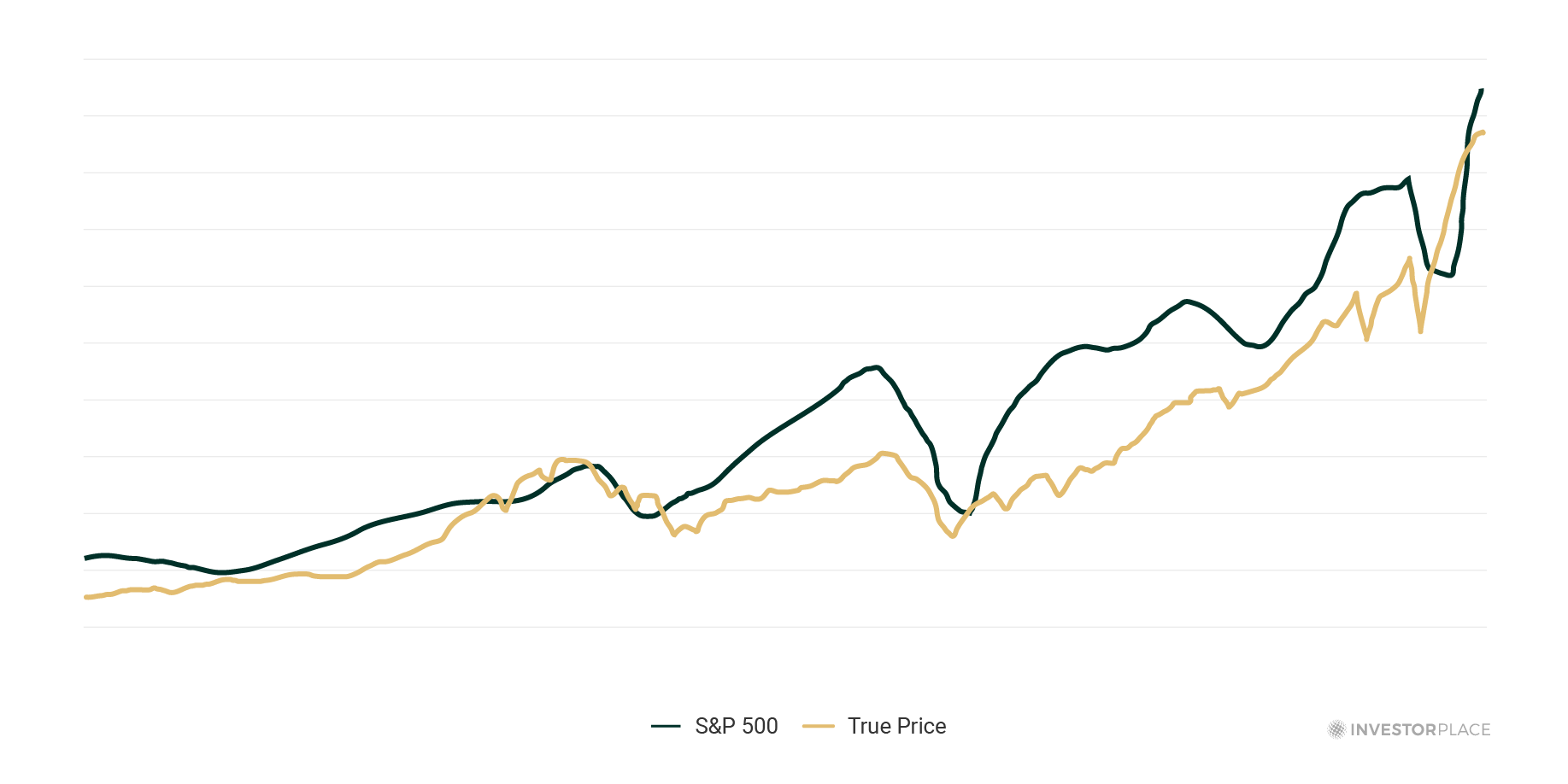

On this page, my goal is to walk you through how I discovered the rare market phenomenon I’m calling the 1,000% Divergence Window…

I’ll show you how this window has produced some of the biggest backtested gains in stock market history…

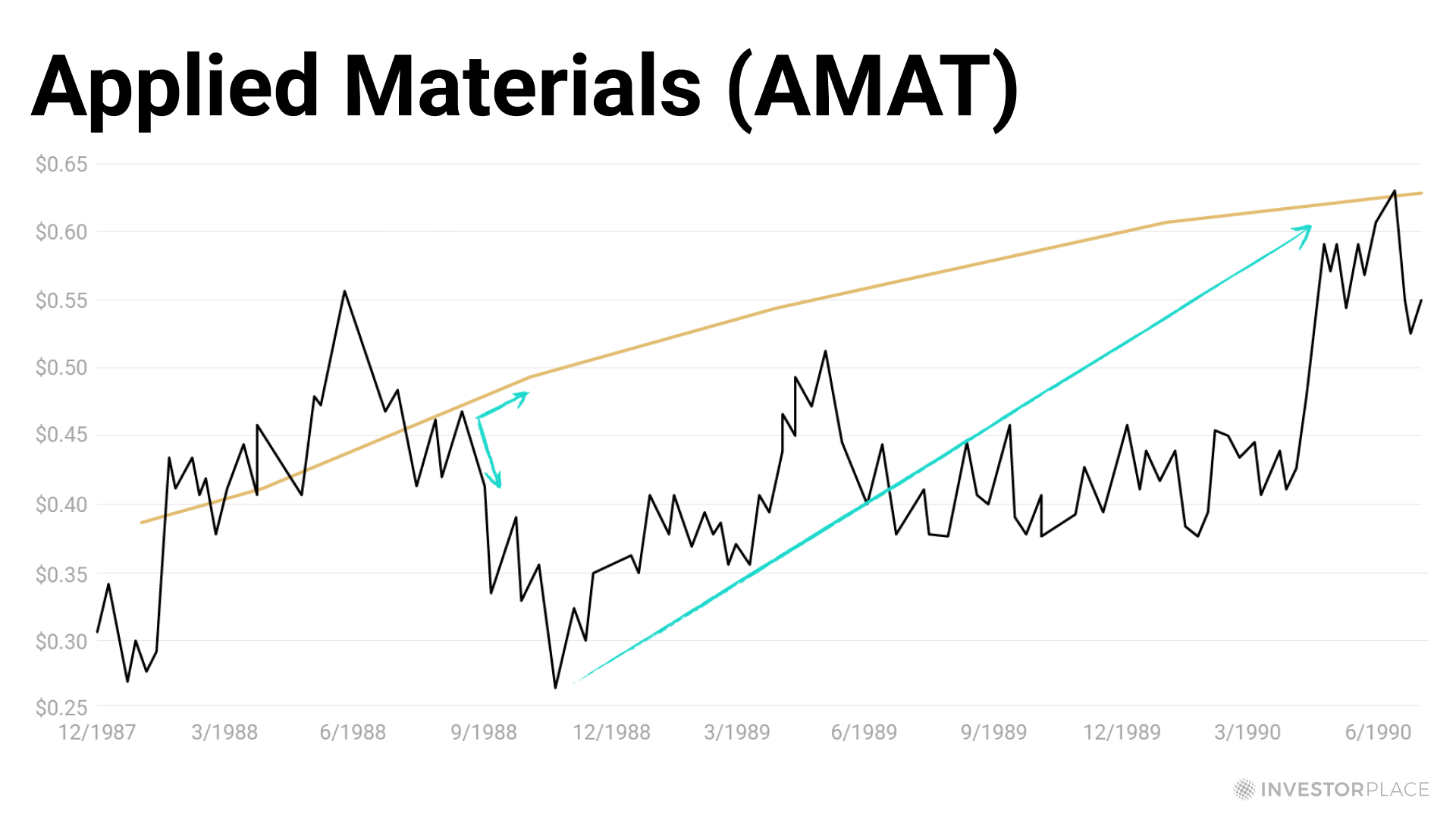

AMAT | 51,030% |

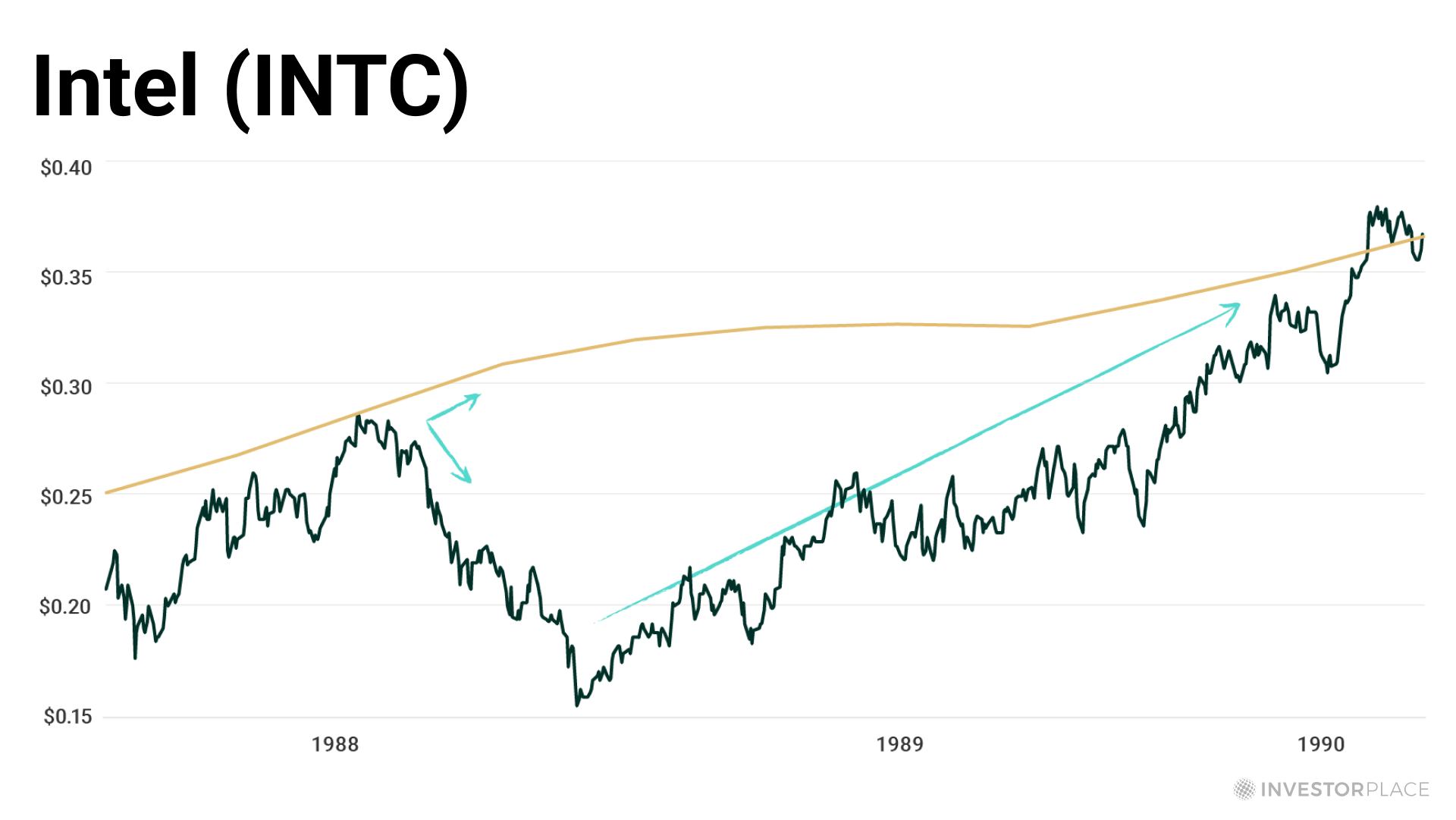

INTC | 31,710% |

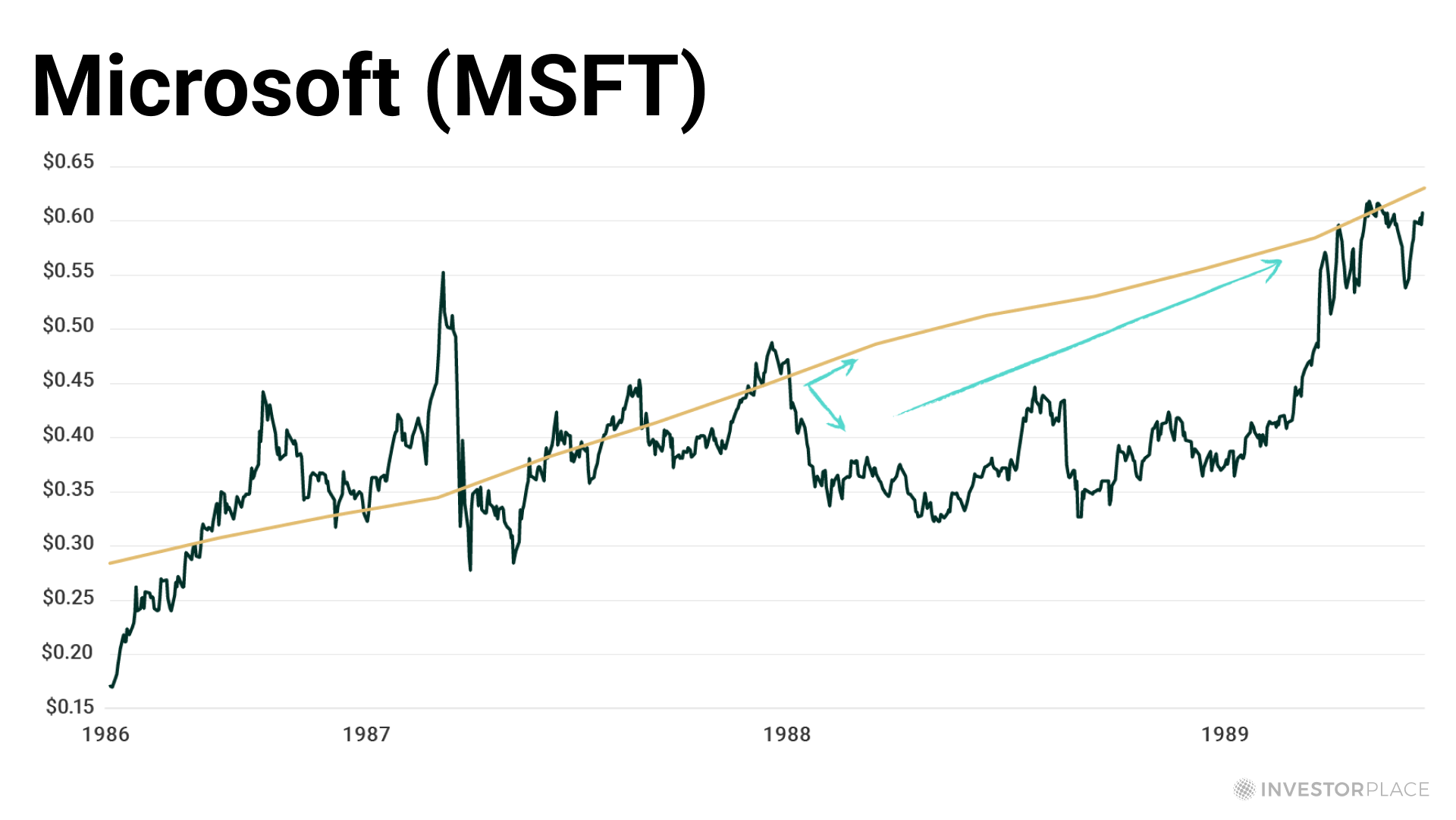

MSFT | 94,410% |

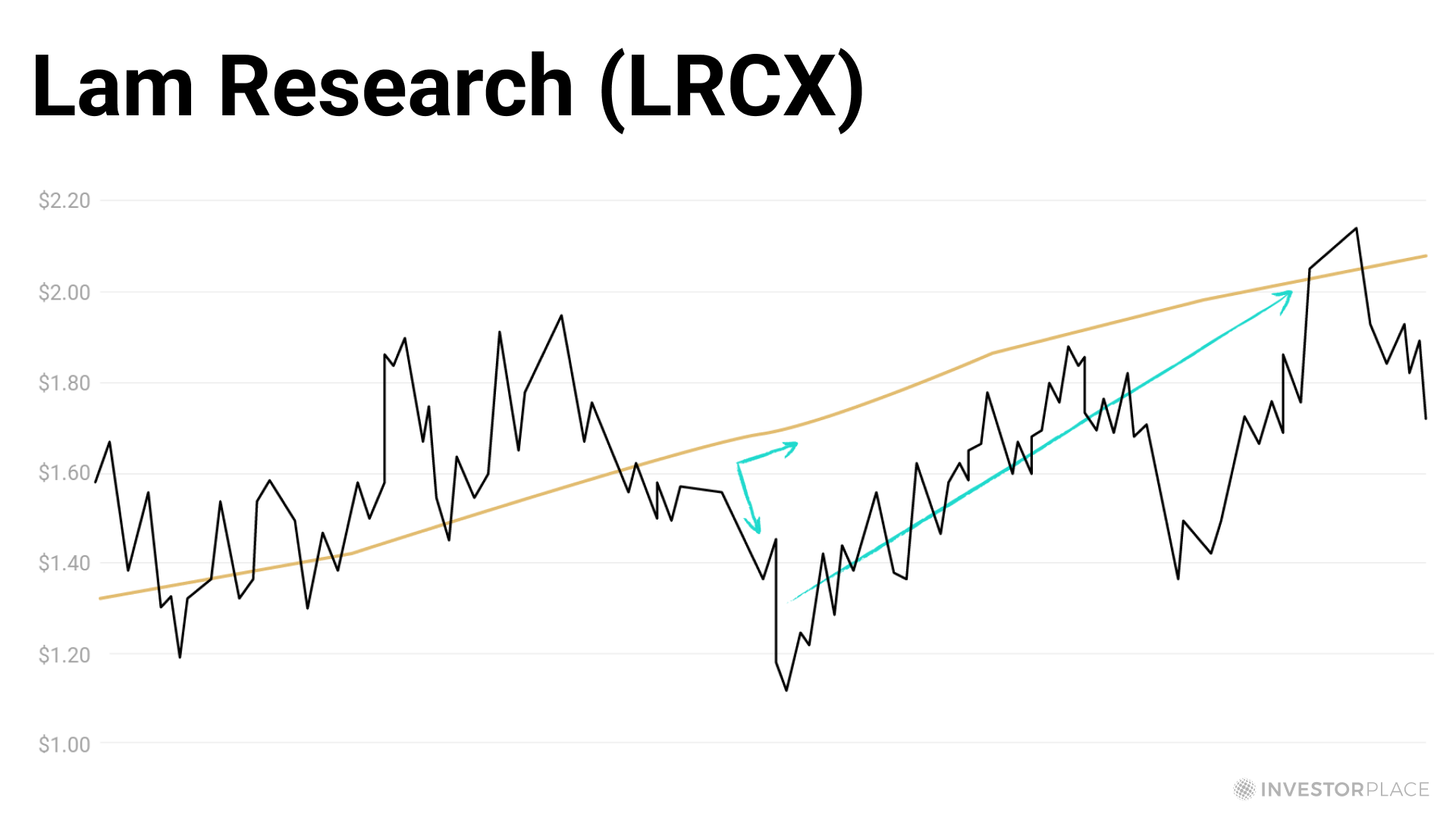

LRCX | 37,600% |

ORCL | 41,190% |

NVDA | 64,260% |

AMZN | 55,140% |

And more importantly, how it could help you put your financial goals on hyperdrive in 2022.

Because based on every shred of evidence we’ve dug up during our 35 year backtest of these windows…

I believe to my core that the divergence window of 2022 will be the biggest wealth building opportunity of the century.

I’m not exaggerating when I say this window could have historically turned thousands… into up to millions.

Once you see the evidence for yourself, you’ll understand what I mean.

It all started with a simple indicator…

| JMIA | 1,638% |

| ROKU | 1,065% |

| AMD | 6,149% |

| AMC | 1,321% |

| BLNK | 3,628% |

| SQ | 1,482% |

| NIO | 3,353% |

| PLUG | 2,596% |

| MNMD | 1,548% |

| CHGG | 2,554% |

| SHOP | 1,585% |

| TSLA | 2,261% |

| WKHS | 1,611% |

| GME | 12,066% |

Discovery: The Divergence Window of 1988

STOCK | GAIN |

AMD | 106% |

AMAT | 50% |

ADP | 28% |

INTC | 70% |

MSFT | 92% |

LRCX | 55% |

ORCL | 195% |

A Second Opinion: Billion-Dollar Fund Manager Louis Navellier Weighs In

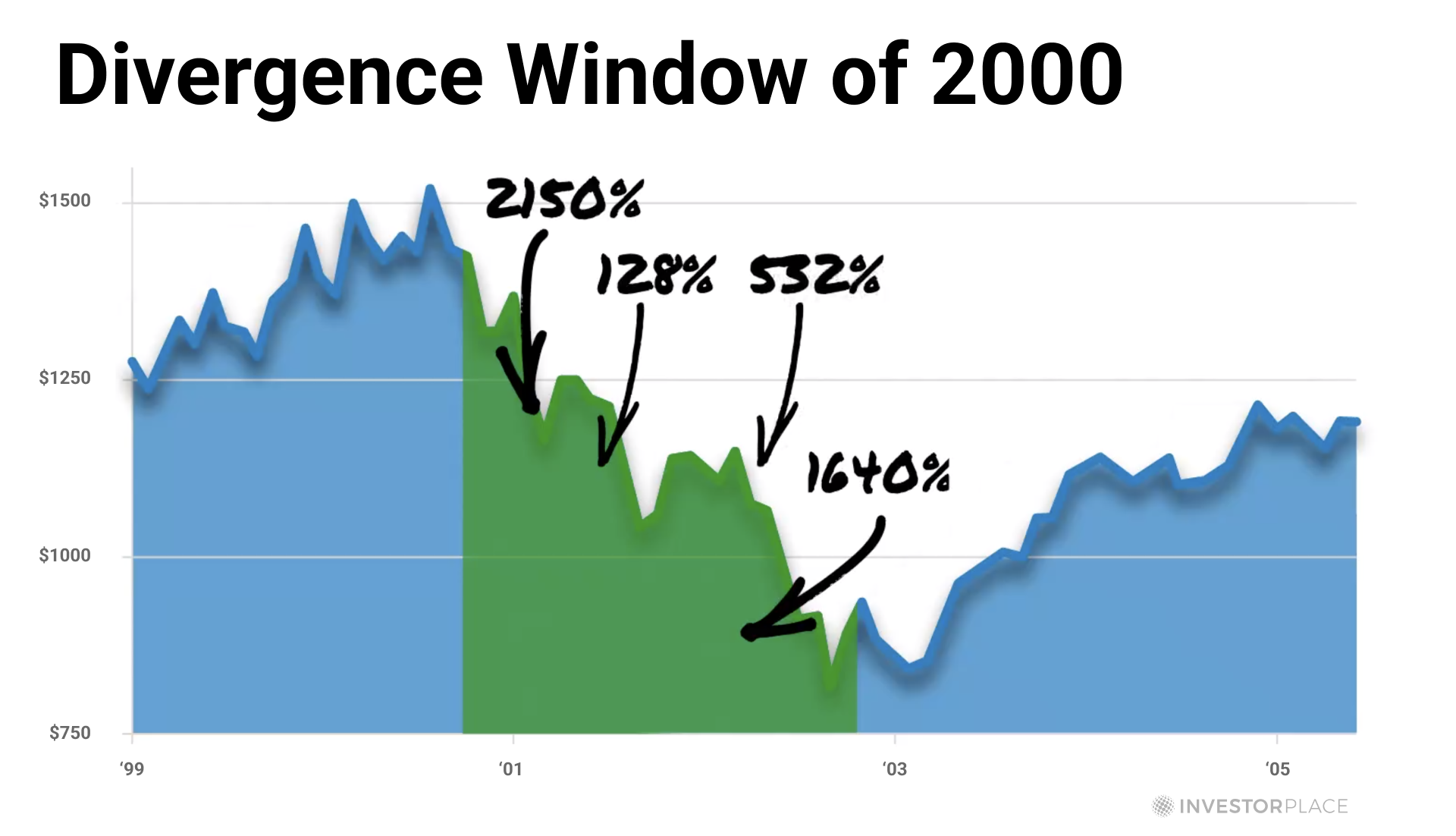

Call to arms: The Divergence window of 2000

| FFIV | 357% | 1,640% | 11,020% |

| AMZN | 185% | 433% | 55,140% |

| MSFT | 61% | 29% | 1,360% |

| EBAY | 128% | 532% | 1,800% |

| INTU | 60% | 128% | 3,910% |

| FDS | 41% | 272% | 3,410% |

| NVDA | 123% | 2,150% | 64,260% |

| Average Return | 136% | 741% | 20,129% |

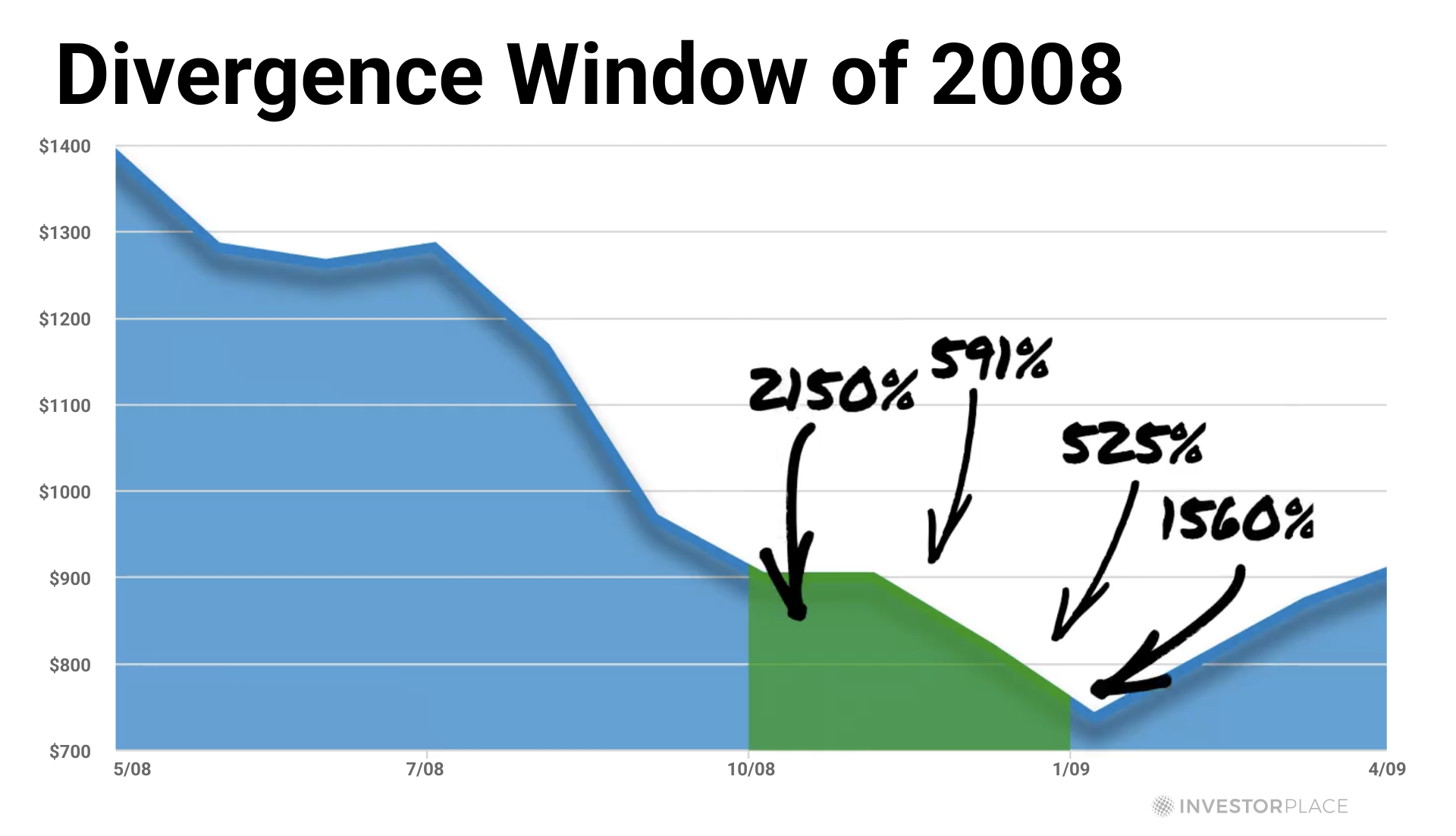

The Final Puzzle Piece: The Divergence Window of 2008

Stock | Phase 1 | Phase 2 | Phase 3 |

NFLX | 202% | 1,730% | 14,640% |

INTU | 46% | 525% | 5,320% |

AMZN | 270% | 935% | 9,330% |

GOOGL | 122% | 1,560% | 11,910% |

BKNG | 265% | 2,150% | 4,480% |

AAPL | 171% | 591% | 6,070% |

CRM | 185% | 861% | 3,750% |

It’s Happening Again: The 1,000% Divergence Window of 2022

What YOU Can Do:

Divergence will strike any day now. The most important thing is to be ready when it does. Sign up below for DIVERGENCE WATCH and you’ll be the first to be notified, receive an emergency briefing when it strikes, and even my top divergence picks. Receive our immediate divergence primer with stocks on our divergence watch list.

Free VIP Reminder Service" sms_description="

As a VIP, you’ll receive one FREE Stock Report each day leading up to this exclusive event… PLUS complementary text message reminders leading up to the event, to make sure you don’t miss a second of the action!

" qs="c76003443ff9837dadc3c269166b1a064cc4f63c196bcd46f094f620f62fdca1" source_eid="MKT630584" mobile_icon_class="" unprotected="true"]